Access Bank Acquires $7m Stake in Kenyan Subsidiary

Access Holdings through its Bank., Access Bank is to invest $7 million into its subsidiary, Access Bank Kenya Plc The capital injection will increase Access Bank Kenya’s shareholder funds and capital ratios The move followed an earlier agreement to acquire sub-Saharan Africa subsidiaries of Standard Chartered Bank.

Access Holdings Plc has invested Ksh1 billion ($7 million) into its subsidiary, Access Bank Kenya Plc, in an effort to strengthen its position in the Kenyan banking industry. This is coming after a major development that saw Access Bank acquire Standard Chartered’s shareholding in its subsidiaries in Angola, Cameroon, The Gambia, and Sierra Leone, as well as its Consumer,private and Business Banking business in Tanzania.

It was earlier reported that the subsidiary of Access Holdings, Access Bank, had acquired a majority stake in Angolan Bank, Finibanco Angola S.A.

Access Bank Kenya’s financial reserves will be strengthened by the $7 million in capital, increasing its shareholder money and capital ratios.! It is envisaged that the capital infusion would meet the unit’s immediate capital needs and strategically position the bank to achieve its growth objectives in the Kenyan market.

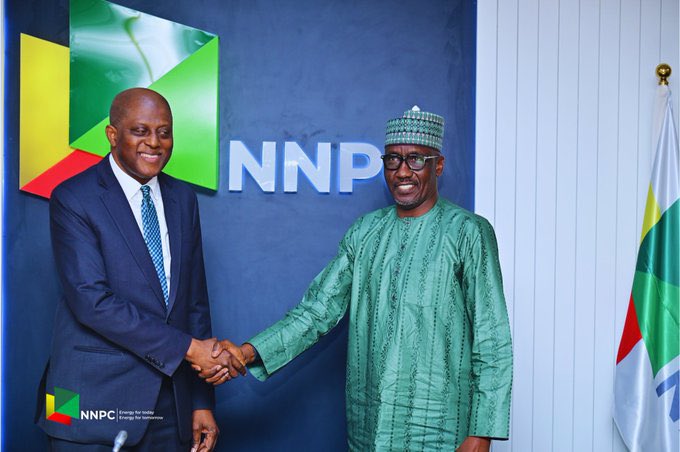

The $7 million in capital is expected to increase Access Bank Kenya’s shareholder funds and capital ratios while strengthening its financial reserves. It is envisaged that the capital infusion would meet the unit’s immediate capital needs and strategically position the bank to achieve its growth objectives in the Kenyan market. Herbert Wigwe,

CEO , Access Holdings while commenting on the development said: “As a leading financial institution on the continent, we remain forward-thinking in our approach to growth and capitalization.” Under Wigwe’s direction, Access Holdings committed a large $300 million capital investment to its main business, Access Bank, earlier this year.

Building on a series of acquisitions that have significantly increased the bank’s impact throughout important trade and payment corridors, this tier-one capital-qualifying Mandatory Convertible Instrument aims to strengthen the bank’s presence across the African continent.

Legit.ng