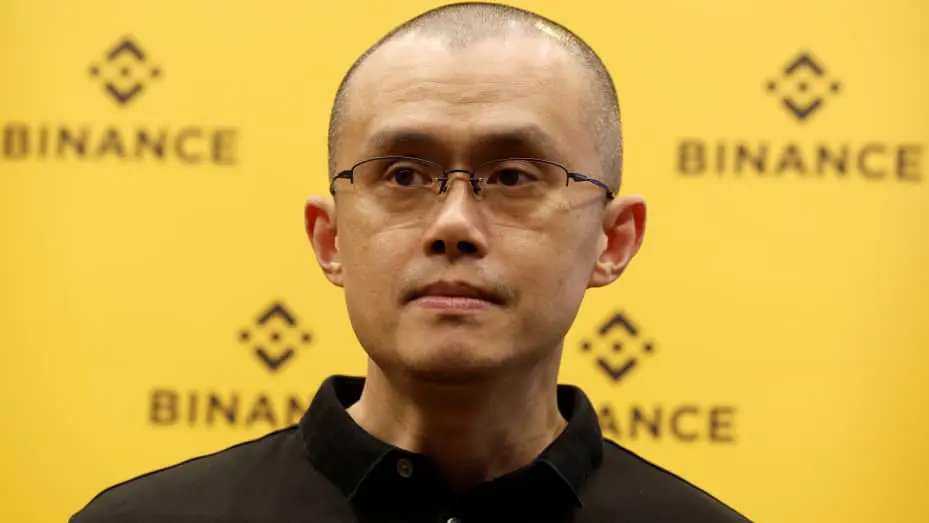

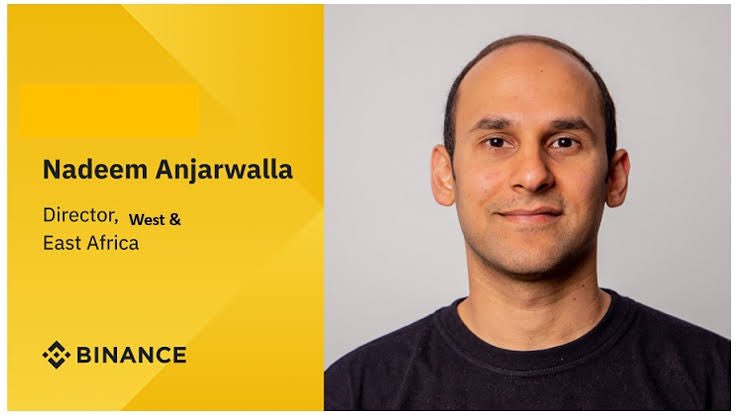

Security Men under investigation over Binance Director’s Escape

Security officers from whose custody Binance Executive Director Nadeem Anjarwalla escaped are under interrogation.

The Federal Inland Revenue Service (FIRS) has filed criminal charges against Binance, a cryptocurrency exchange platform accused of aiding money laundering and terrorist financing.

The Federal Government yesterday said security agencies are working with the International Criminal Police Organisation (INTERPOL) for a global arrest warrant for Anjarwalla.

The Africa Regional Manager of Binance was arrested on February 26 on arrival in Nigeria, along with his colleague Tigran Gambaryan.

He escaped from lawful custody on Friday.

Head of Strategic Communication in the Office of the National Security Adviser (ONSA), Zakari Mijinyawa, said in a statement that a preliminary investigation revealed that Anjarwalla fled Nigeria using a smuggled passport.

The statement reads: “The ONSA confirms that Nadeem Anjarwalla, a suspect in the ongoing criminal probe into the activities of Binance in Nigeria escaped from lawful custody on Friday, 22 March 2024.

“Upon receiving this report, this office took immediate steps, in conjunction with relevant security agencies, MDAs, as well as the international community, to apprehend the suspect.

“Security agencies are working with Interpol for an international arrest warrant on the suspect.

“Preliminary investigation shows that Mr Anjarwalla fled Nigeria using a smuggled passport.

“The personnel responsible for the custody of the suspect have been arrested, and a thorough investigation is ongoing to unravel the circumstances that led to his escape from lawful detention.

“The Federal Government of Nigeria, like other governments around the world, has been investigating money laundering and terrorism financing transactions perpetrated on the Binance currency exchange platform.

“Until his escape, Nadeem Anjarwalla, who holds British and Kenyan nationalities and serves as Binance’s Africa regional manager, was being tried by Nigerian courts.

“The suspect escaped while under a 14-day remand order by a court in Nigeria. He was scheduled to appear before the court again on April 4, 2024.

“We urge the Nigerian public and the international community to provide whatever information they have that can assist law enforcement agencies to apprehend the suspect.”

FIRS slams tax evasion charges on platform.

It accused Binance of four separate tax offences: non-payment of Value Added Tax (VAT), Company Income Tax (CIT) evasion, failure to file tax returns and “aiding customer tax evasion”.

The FIRS, in a statement, said the charge goes beyond non-registration, as Binance failed to adhere to existing Nigerian tax regulations.

The statement reads: “The Federal Government also accused Binance of failure to register with FIRS for tax purposes and contravening existing tax regulations within the country.

“One of the counts pertains to Binance’s alleged failure to collect and remit various categories of taxes to the federation as stipulated by Section 40 of the FIRS Establishment Act 2007 as amended.

“Section 40 of the Act explicitly addresses the non-deduction and non-remittance of taxes, prescribing penalties and potential imprisonment for defaulting entities.”

FIRS accused Binance of neglecting to register for tax purposes as required by law, while the platform’s operations violated established tax regulations.

Binance, the agency said, failed to issue invoices for VAT purposes, hindering the proper assessment and payment of taxes by its Nigerian users.

Binance, Gambaryan and Anjarwalla are the first, second and third defendants.

The charge comes after Binance pleaded guilty to violating anti-money laundering laws in the United States in late 2023.

The company settled the charges through a plea bargain that resulted in a $4.3 billion penalty.

The case represents a major development in regulating cryptocurrency activities in Nigeria.

The outcome will be closely watched by industry players and could set a precedent for future regulation of the cryptocurrency sector in Nigeria.

FIRS restated its commitment to enforcing tax regulations and tackling financial misconduct within the cryptocurrency sector in the exercise of its power to assess, collect, and account for federal revenue and administer relevant tax laws.